Chairman of the Board Of Avia Solutions Group Gediminas Ziemelis: Representing 6% of global fleet, ACMI market could soon experience deficit

As the COVID-19 wanes sluggishly, the aircraft leasing market is likely to experience an increase in demand. Mainly, this will result from the growing demand for new aircraft as more and more airlines try to provide expanded capacity for the snowballing numbers of passengers and the surge in demand for cargo aviation.

As the COVID-19 wanes sluggishly, the aircraft leasing market is likely to experience an increase in demand. Mainly, this will result from the growing demand for new aircraft as more and more airlines try to provide expanded capacity for the snowballing numbers of passengers and the surge in demand for cargo aviation.

Current projections indicate that the aviation industry will inject up to £148 billion in funding the booming demand for new aircraft by 2023 and even more in the succeeding years. The need to acquire new aircraft to meet the requirements for increased aircraft capacity will likely push airlines to consider alternative ways to avoid the financial burden and other challenges of purchasing them. As a result, aircraft leasing may emerge as the most attractive option even for airlines seeking to increase their capacity, albeit temporarily.

Today, many airlines are less concerned about when demand will return. Indeed, the pressing question is how they will respond to the challenge of the increasing aviation demand. For many, passenger recovery would mean more aircraft departures and increased utilization which may have a net negative impact on pilot supply.

Regarding magnitude, the expected decline in global pilot supply will hit 34,000 pilots between now and 2025. However, the figure may clock at 50,000 in the worst-case scenario, signaling real challenges for small and big carries. The outright reasons explaining the pilot deficit problem include the increasing numbers of pilots going into retirement, defections, change of careers, furloughs, and fleet growth.

The pilot shortage problem may compel some airlines to enter into short-term dry lease agreements, where they hand over some of their aircraft to other companies with a bigger supply of in-service pilots rather than cancelling hundreds of flights due to flight shortages. However, an increase in demand for dry leasing by major airlines will ultimately cause a leasing deficit, as the number of carriers pursuing ACMI solutions exceeds that of airlines providing such services. Even with such big players like Lufthansa, which in their latest strategy is reactivating temporarily parked aircraft and the use of seasonal wet-lease capacities, might not be enough to meet the demand.

Conceivably, some airlines may experience aircraft shortages, given that part of their existing fleet cannot return to service because they require maintenance. As a result, this will push the demand for Maintenance, Repair and Overhaul (MRO) services. Current forecasts indicate that the value of the aircraft MRO market will increase from £57.96 billion in 2021 to £79.47 billion by 2028 due to the growing demand for MRO services.

MRO market drivers point to a possibility that the market may experience problems providing extra capacity, meeting the operational demands, and maintaining the expected functional conditions for aircraft maintenance, repair, and overhaul as the demand surpasses available capacity. A shortage in supply for MRO services from existing providers would translate to more airlines pursuing other options, such as ACMI solutions to have their aircraft serviced.

The International Air Transport Association (IATA) data indicate that the demand for global cargo aviation has continued to soar despite the challenging operating and financial backdrop.

During the pandemic, the aviation industry noted a 54% decline in belly freight in the reported figures in 2019. It is expected that more than 800 wide-body aircraft operating in cargo aviation will retire from services, meaning that the available belly capacity will go below pre-COVID levels. For many airlines, the only feasible way to get themselves out of the situation is by initiating dry lease agreements with other carriers to increase their cargo capacity. However, this may not provide a sustainable solution to the surging cargo aviation demand. The available ACMI operators may start to experience challenges in servicing many airlines seeking to enter into leasing agreements.

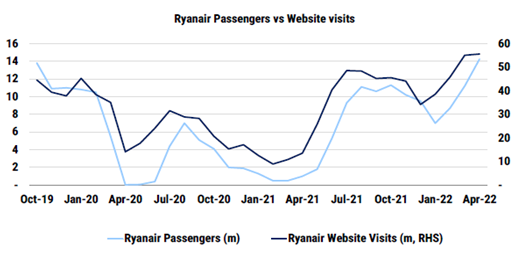

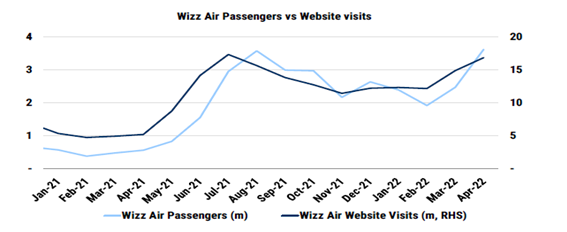

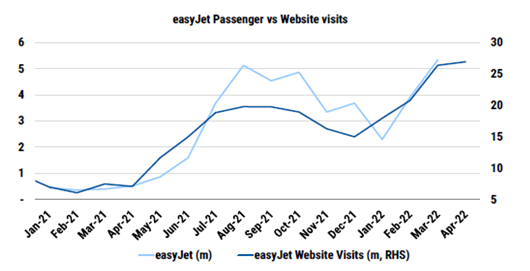

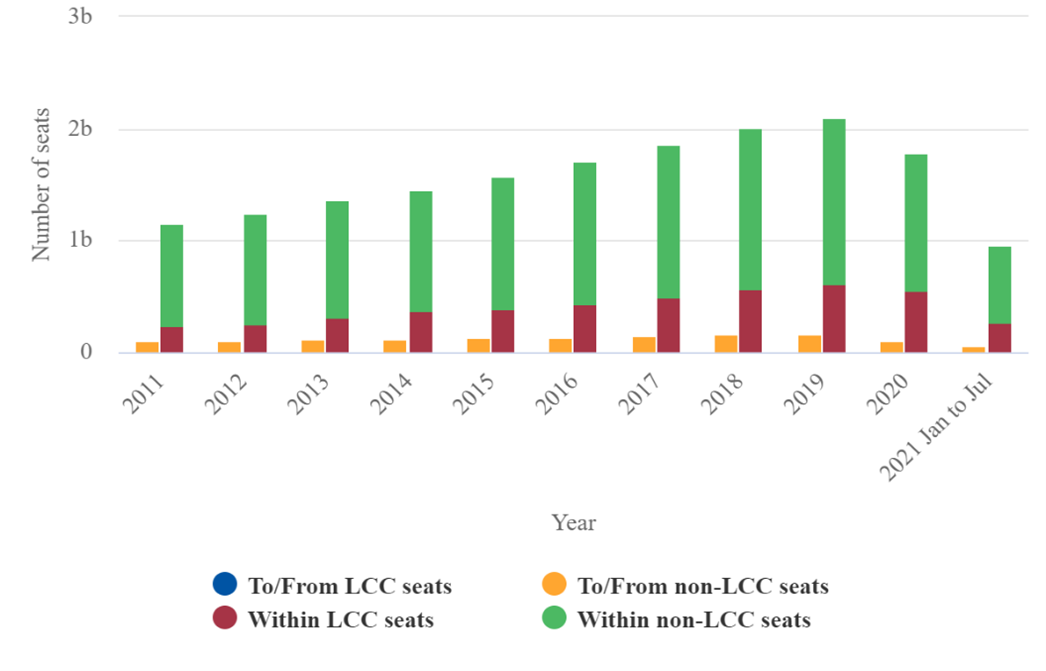

If the current trends are anything to go by, the rundown is that low-cost carriers (LCCs) will become the next big thing in commercial aviation. LCCs such as Wizz Air and Ryanair have emerged as some of the biggest winners since the pandemic, with their monthly passenger traffic increasing by 10% and 5% of their 2019 figures. Along with this trend, more LCCs have started to emerge, with companies like Akasa Air of India, Arajet of the Dominican Republic, and Bonza Air of Australia making their headway into the low-cost segment.

Exhibit 1: Ryanair has reported a steady increase in customer bookings since January 2021

Exhibit 2: Wizz Air bookings for LCC started to pick in April 2021

Exhibit 3: EasyJet’s LLC bookings have remained on an upward trend since April 2021 but slowed towards January 2022 but have consistently improved to date

Exhibit 4: Reported growth of the old Asia-Pacific LCCs before and during the pandemic

Given the huge potential presented by the ACMI market, the management of Avia Solutions Group and its AOC companies are preparing to operate 137 ACMI aircraft for passenger and cargo aviation markets, starting in August 2022.

ACMI leasing has offered a flexible solution to current and future operational challenges and strategic capacity requirements experienced in commercial aviation. Aircraft leasing provides an urgent short-term cover for airlines to minimize service disruption from unexpected issues such as crew shortages or limited access to aircraft maintenance services. However, an increase in leasing demand may result in ACMI deficits, leading to order backlogs and other risks associated with aircraft leasing.