Aviation in Latin America: Summer is Over – Now What?

Summer 2022, highly anticipated by airlines, eventually arrived, demonstrating, and confirming the positive trend in the industry’s recovery – thanks to the lifted restrictions, open borders, and the higher capacity deployed by different operators. However, this season the airplanes have also had to fly through the turbulence caused by high fuel costs, sharp depreciations in some countries of the region, and disruptions in airports due to a lack of staff, all adding to the capacity challenges, in order to meet the sudden growth in passenger demand.

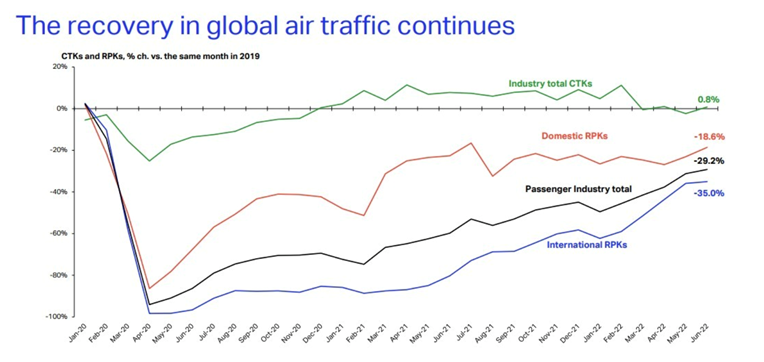

At the beginning of 2022, the optimism was high for the summer, owing to the rollout of vaccination programmes around the world, the lifting of flight restrictions, the opening of borders, and the recovery of air travel at the global level. Nevertheless, as commented in the IATA’s last meeting, no one expected such an abrupt change in the geopolitical situation caused by the war in Ukraine and what this would mean for the industry, reflected in the rapid increase in fuel prices, which in June 2022 rose from 80 to 120 US dollars per barrel.

The increased activity of low-cost carriers (LLCs), especially in Latin America, continued to help grow their market share, confirming passengers’ acceptance of this type of model due to the low-cost structure and reduced prices. However, the exposure to sales in domestic markets has put high financial pressure on low-cost airlines, given the depreciation observed in Colombia, Chile, and Peru, as well as high fuel prices. It was observed that several airlines managed to mitigate increased fuel prices and depreciation costs through ticket prices.

Furthermore, new airlines, including Ultra, Arajet, Equiar, and Canada Jetlines were launched in several regions, ratifying the moment for setting into motion new operations that started during the pandemic, taking market opportunities for a cost-efficient structure. There’s hope that they continue to move forward and create value in the market with new proposals for connectivity, service, as well as new routes to strengthen the current regional industry.

Summer’s ending – what’s next?

Several questions remain for upcoming months, which should be left to strategists: how will COPA, Aeroméxico, and Azul move in the region, and will we see LCC consolidation processes with the aim of adding synergies?

It is clear that the present conversation between airlines remains to be focused on profitability, efficiency, and cash flow generation. Gone are the days when priority was only given to market share as the main indicator; now the aim is to achieve the lowest CASK possible, the highest turnover, and network and cost optimization.

This new focus continues igniting the search for new and different operational models or replicates models that are successful in Europe, which can meet the demand without having to invest in CAPEX. Today, we are faced with a scenario that requires greater use of aircraft, quick turnarounds, and as few grounded aircraft as possible. For this reason, there is a need to implement buffers or fleet flexibilization systems, in the way that is done by airlines as important as Lufthansa, which, through ACMI (Aircraft, Crew, Maintenance, and Insurance) or wet-lease, can increase their capacity during summer peaks, thus reducing the need for airplanes in winter, optimizing CAPEX and operational costs. Airlines like Avion Express, operator of Airbus A320 family fleet, are positioned in this passenger market under ACMI as the leaders in the industry of such models. This means that the development of said capacities can continue in Latin America. The invitation is also issued to regulators, civil aviation authorities, and ministries of transport, to enable them to continue developing new regulatory frameworks for pushing this industry forward for the benefit of better operational structures that are reflected in lower prices for passengers.

This “pause” in today’s path and the future that lies before us clearly show the significance of the airline industry and the importance of developing airport infrastructure in Latin American countries, accompanied by the development of new regulations that adjust to new operational models that benefit passengers.

It is true that we are returning to longer taxi times to reach the head of the runway, which reflects a higher volume of traffic before take-off and an increase in the number of flights in operation. For this reason, as the captain says, “sit back and enjoy your flight!”